It’s important to remember, however, that your net worth changes all the time. You simply add up all of assets and all of your debts and subtract your debts from your assets. Tracking your net worthĬalculating your net worth is easy. It’s important to ask: Is my net worth going up or down this month? What about this year? Your net worth is less important than your net worth trend. Obviously, you want to build a positive net worth, although if you’re starting out in life with student debts and not a lot of savings, yours will probably be negative for a while.

If you only have $1,000 in the bank and a $2,000 credit card balance, you would have a net worth of -$1,000. So in a very simple example, if you have $10,000 in the bank and owe $2,000 on a credit card, you have a net worth of $8,000. Your net worth is a measure of your finances calculated by taking the sum or your assets and subtracting your liabilities (debts). I believe that if you’re going to ensure that you’re regularly living below your means and building wealth, you need to track your net worth. Because of that, I’m way over my budget some months and under some other months. But for me, a good chunk of the money I spend annually goes to things that I don’t pay for ever month like:įor this reason, I find that monthly doesn’t account for this stuff. True, we pay a majority of recurring expenses like rent, debt payments, and utility bills once a month. Loan Payoff Calculator: How Quickly Can You Repay Your Loan?.Auto Loan Interest Calculator: Monthly Payment & Total Cost.

Wealth tracker excel pdf#

Free Monthly Budget Spreadsheet for Excel & PDF.

Wealth tracker excel how to#

Wealth tracker excel full#

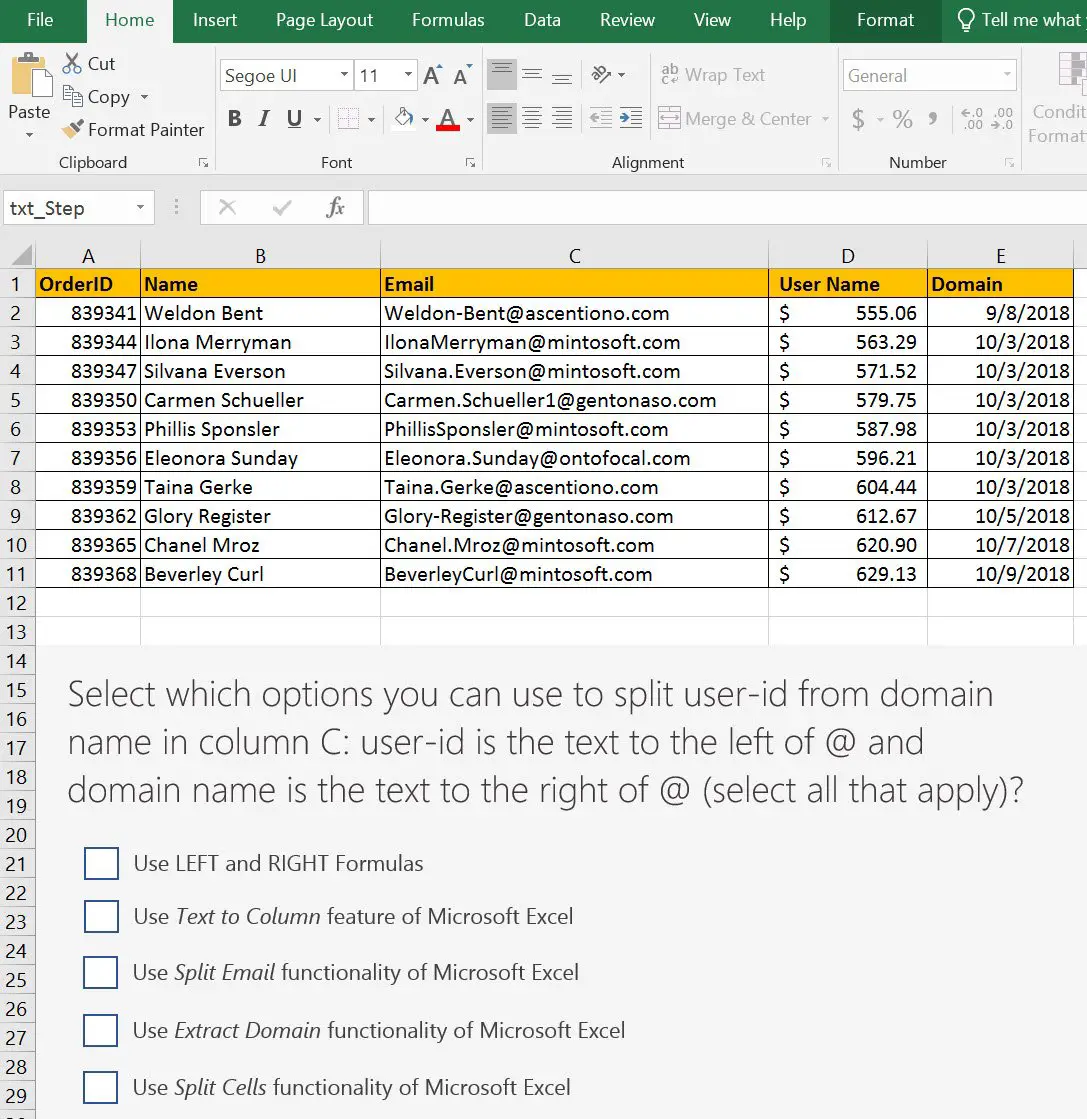

Using these features to their full ability in Excel requires some special training, though. They can also easily help communicate this to others. Visualizations can be especially important because they can show you how much you’re over (or under) spending in any given area. This advertisement has not loaded yet, but your article continues below.

0 kommentar(er)

0 kommentar(er)